Navigating the Healthcare Landscape: A Comprehensive Report on the Role of Health Insurance in Cancer Care

By Venkataramani Suresh, Co-Founder and CBO, Karkinos Healthcare

Cancer treatment can be expensive, encompassing hospitalisation, surgery, medications, and potentially ongoing care. Health insurance plays a vital role in managing these costs. This white paper explores the nuances of health insurance in cancer care and also defines Karkinos Healthcare’s Distributed Cancer Care Network (DCCN) model making an impact on insurance-led cancer care services in India.

Global Health Insurance Trends

The worldwide health insurance market has grown at around 4.5% CAGR between 2020 and 2023. The global market, valued at around 2.4 billion USD in 2023, is forecasted to exceed 3.9 billion USD by 2030, demonstrating a 7% CAGR.

The Asia-Pacific region is anticipated to experience the highest growth at approximately 9% CAGR. The health insurance market is expanding due to an increasing prevalence of chronic diseases, soaring healthcare costs, heightened government investments, policy implementations, and growing awareness.

A staggering over three-quarters of all deaths is already attributed to non-communicable diseases (NCDs) like heart disease, cancer, diabetes, and chronic respiratory illnesses, according to the World Health Organization (WHO, 2023). This concerning trend is expected to worsen, with NCDs projected to cause 86% of deaths globally by 2050, representing a massive 90% increase since 2019 (WHO, 2023).

India Health & Medical Insurance Market

The Indian health & medical insurance market is experiencing vibrant growth, fueled by several key trends identified by our research experts. Let’s explore these factors:

Government-Subsidized Schemes Drive Increased Coverage:

- Large-Scale Initiatives: Big government programmes like Ayushman Bharat and PM-JAY, covering millions of families, provide a significant boost to market growth.

- Financial Inclusion: Focussed efforts to include less privileged segments expand the reach of health insurance across diverse populations.

- Enhanced Accessibility: Government schemes like AB PM-JAY offer substantial financial coverage for secondary and tertiary care, making it more accessible to vulnerable groups.

Impact of Government Initiatives:

- Strong Regulatory Environment: Clear regulations support a stable and predictable market, encouraging new players and innovations.

- Strategic Partnerships: Collaborations between government and private entities open up new distribution channels and product offerings.

- Product Diversification: Insurers develop new health insurance plans tailor-made for specific needs and demographics, further driving market expansion.

Gaps in penetration of health insurance in India

The healthcare segment in India is considerably large in terms of revenue and employment. The market is further segmented into public and private categories. Adoption of health insurance in India – a part of non-life insurance, is gradually increasing especially with the recent technological innovations such as digital cash, telemedicine, blockchain, data, artificial intelligence and so on. The Ministry of Family and Welfare has seen an increase of 3.43% of health insurance in 2023-2024 as compared to 2021-2022.

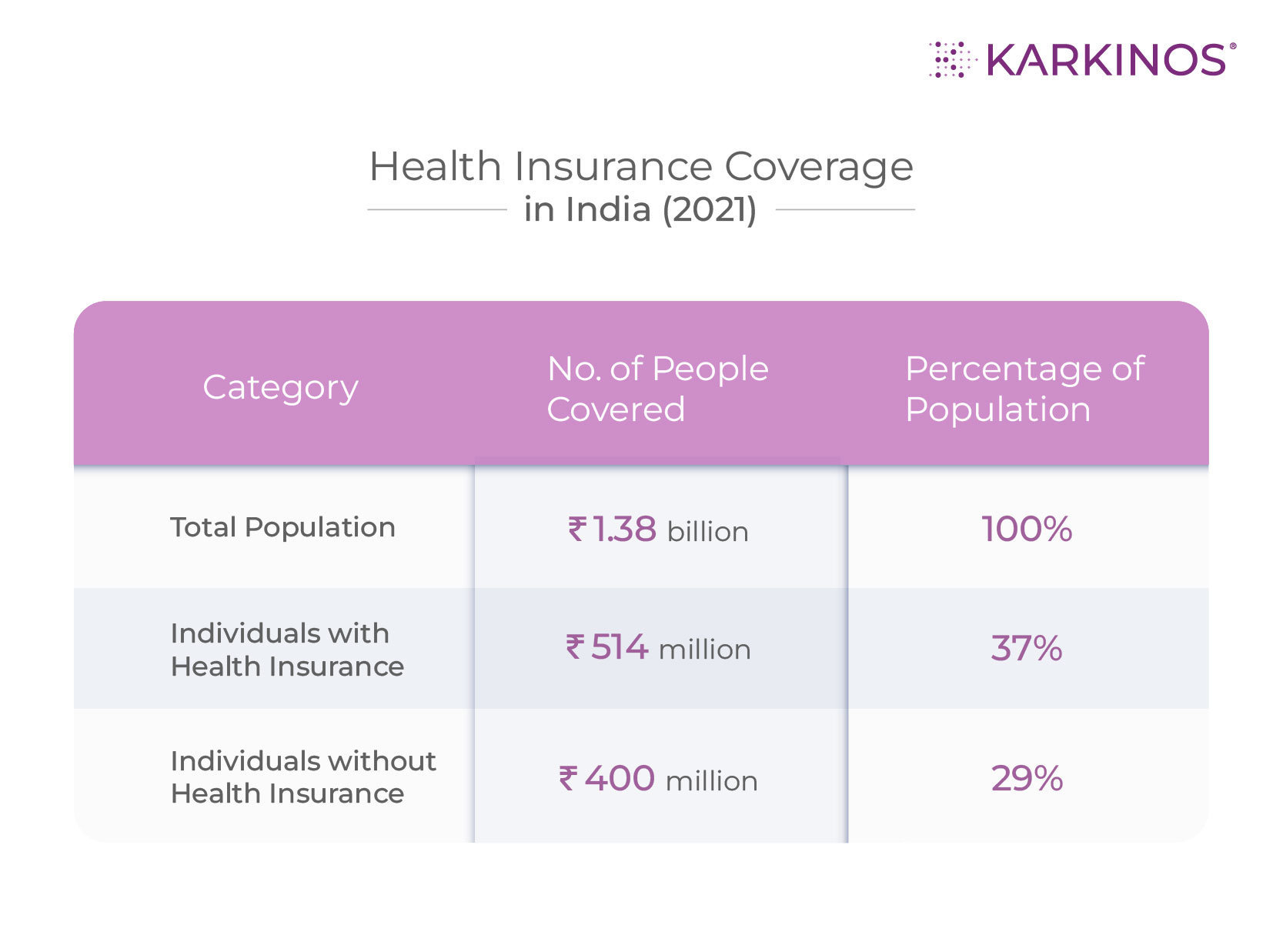

Over 514 million individuals were covered by health insurance schemes in FY 2021. While still a smaller segment, individual insurance plans indicate a growing trend towards personal investment in health protection (India Health and Medical Insurance Market Insights, n.d.)

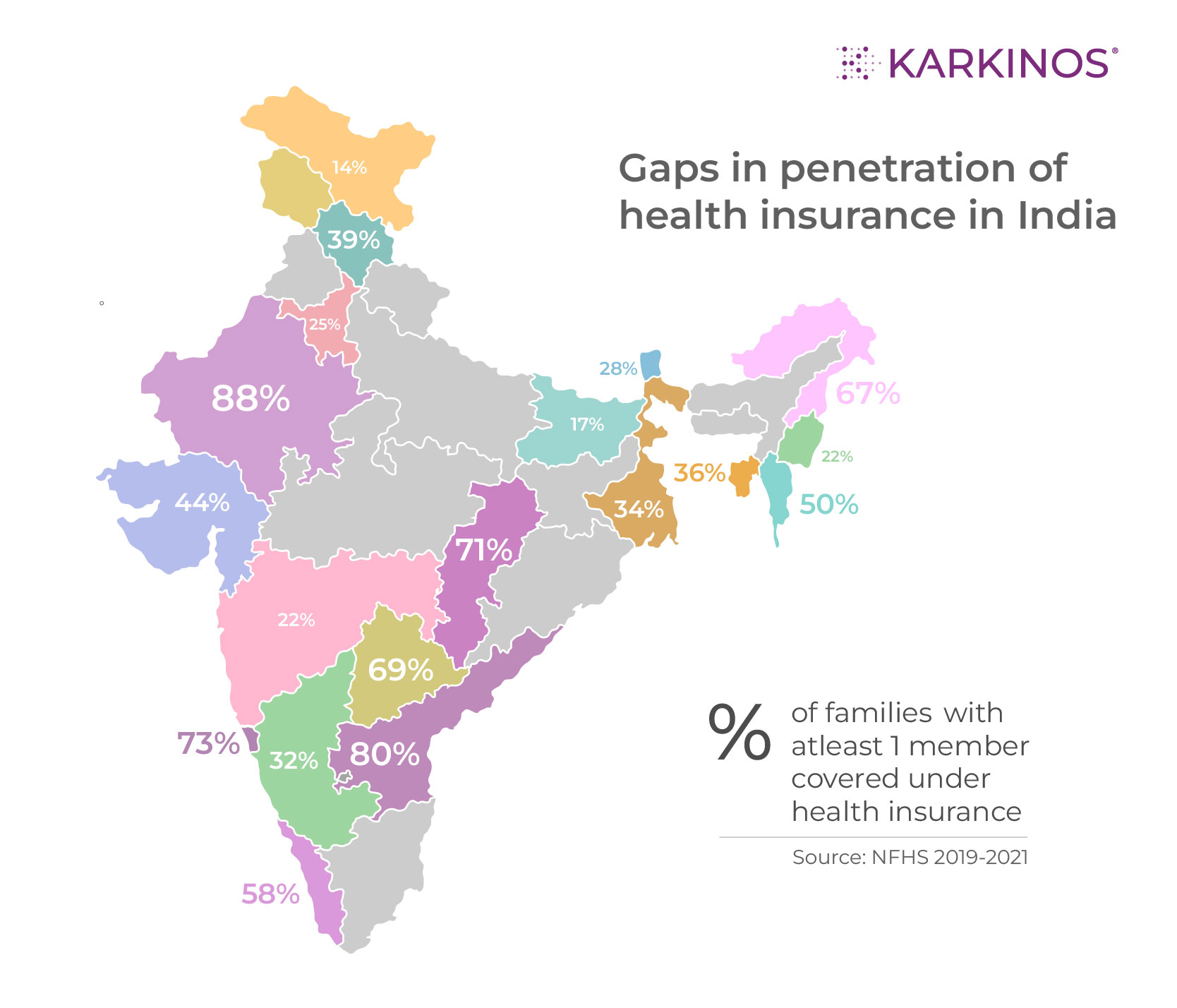

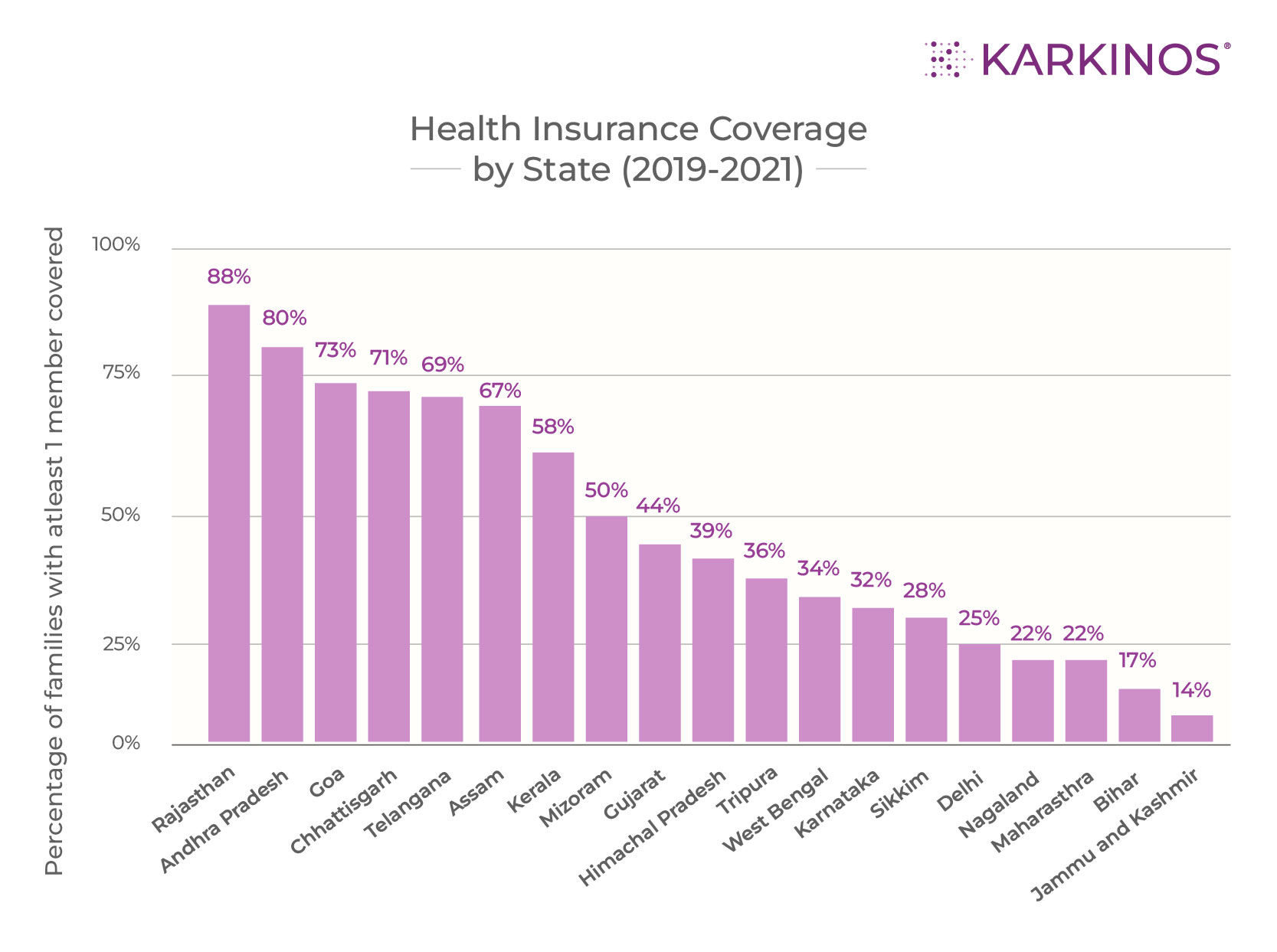

However, the adoption of healthcare insurance is still at a low rate compared to other countries. India faces a lot of issues in the management and implementation aspects of insurance that start right from the fundamental awareness and education concepts. In 2021 only 37% are insured whereas nearly 400 million do not have any health insurance. The National Family Health Survey of 2019 – 2021 shows the health insurance adoption state wise as below:

Various studies and articles claim that the health insurance market in India has great opportunities to expand further. However, they also agree on the common factor that there are many factors that are playing a direct and indirect role in hindering the insurance market to reach its potential.

The Economic Times article titled “Cancer care is expensive” mentions that there is massive misinformation and underperformance about and in the health insurance sector respectively. There are large assumptions stating that health insurance is expensive, and that few NCDs such as Cancer is genetic and inevitably lead to death. These assumptions, coupled with low financial literacy and low awareness are the reasons behind low penetration in India.

These observations are also seen in the health insurance market analysis paper by Dutta (2020) “Health Insurance sector in India: An analysis of its performance”.

A SWOT and PEST analysis reveals that the most prevalent weakness in the market stems from low investment. The public sector insurance providers are still preferred largely over private sector players due to higher affordability and better coverage and solutions. The additional fact of the service tax being increased on premiums, to a staggering 18%, is not benefitting the public in terms of affordability. There is also an increasing high claim ratio, which also includes an increasing number of false claims. With a rise in population of the younger generation, there is no increase in the adoption rates.

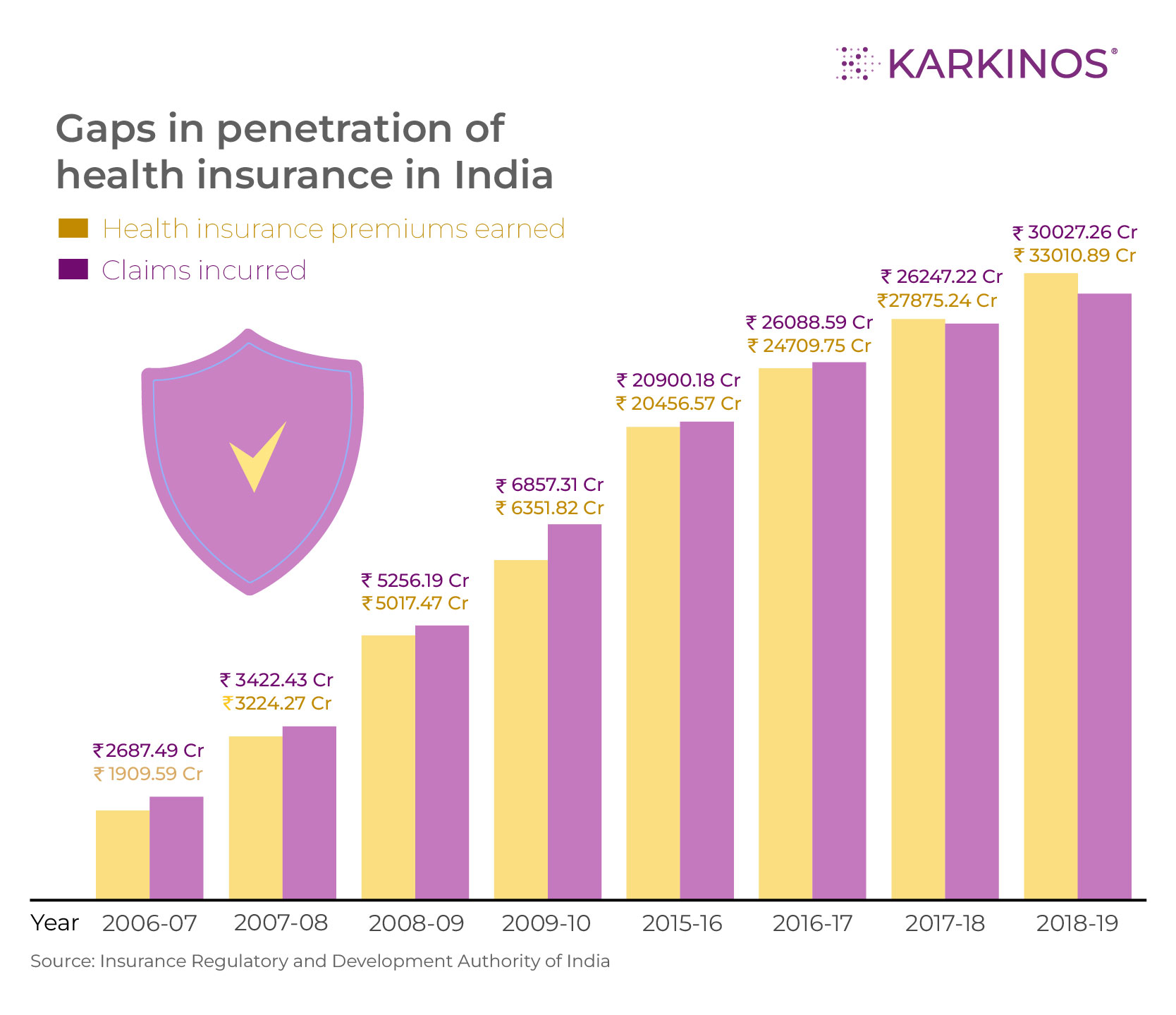

The data from Insurance Regulatory and Development Authority of India shows the following disparity between premiums earned and claims incurred:

Gambhir, Malhi et al (2019) in their paper mention that individuals with low awareness and low financial literacy, in both the rural and urban areas, take advice about insurance from private practitioners who charge a double fee and spend twice as amount on treatment. However, the authors also note that the public health institutes mainly make contracts with corporate hospitals based in urban areas and increase the costs of treatment.

For there to be higher penetration of health insurance, there should be changes in both the insured and insurers in terms of awareness, adjusting the losses, focusing on lowering costs and better financial planning in order to ensure and insure health.

Impact of health insurance on cancer care

The shadow of cancer casts a long and expensive reach, leaving many facing financial burdens alongside their health struggles. While traditional health insurance offers a safety net, it may not be enough to withstand the onslaught of costs associated with specialised cancer treatments. The limitation of traditional health insurance is that standard plans offer basic coverage but may fall short for cancer’s complex and expensive treatments.

Cancer’s Growing Threat:

- Cancer’s impact transcends borders, affecting millions globally.

- Diagnosis and treatment inflict emotional and financial strain on patients and families.

- The financial burden is particularly heavy for primary breadwinners, potentially jeopardizing savings and family stability.

- India’s rising cancer cases (20 lakh annually, 7 lakh deaths) highlight the need for specialised coverage beyond traditional health insurance.

Benefits of Cancer Cover:

- Targeted Focus: Covers various cancer stages, treatments, and related expenses.

- Financial Safeguard: Addresses high-cost treatments like surgery, chemotherapy, and radiation.

- Income Replacement: Provides crucial financial support during treatment-induced income disruptions.

- Holistic Support: Covers rehabilitation, counselling, and wellness programmes for comprehensive care.

- Global Coverage: Some plans offer flexibility for seeking international treatments.

- Early Detection: Encourages and covers regular screenings, crucial for improved outcomes.

Securing coverage for pre-existing cancer can be challenging due to higher risks. However, insurers are offering specialised plans catering to such individuals. These plans cover diagnostic tests, treatment, and post-treatment care. Careful evaluation of terms and conditions is crucial.

However, due to a lack of awareness and education about health insurance coverage, individual research on this is difficult (Why Cancer Cover in Health Insurance Matters More Than You Think, n.d.).

Factors to Consider When Choosing a Comprehensive Health Insurance Plan:

Focus on the scope of coverage and ensure it includes room rent, doctor fees, surgery, pre/post-hospitalization expenses, daycare procedures, diagnostics, and even critical illness riders or alternative therapies if needed. Consider the sum insured and tailor it to age, medical history, family background, and expected inflation to avoid out-of-pocket costs.

Network matters since it is essential to prioritise plans with a wide network of hospitals, cashless hospitalization options, and a proven track record for claim settlement. Claim settlement ratio and industry comparisons offer valuable insights into the insurer’s efficiency in settling claims.

Explore add-on benefits like ambulance coverage, OPD services, and wellness programmes that can enhance the plan’s value. Premiums, co-pays, deductibles, waiting periods, and renewal clauses are advised. It is important to understand these financial aspects to ensure affordability and avoid unexpected costs (Ray, 2024).

Cancer is a major public health burden in India. It is expensive to treat, potentially crippling finances and impacting families. Health insurance penetration in India is one of the lowest in the world, leaving many vulnerable (Spotlight, 2023).

Despite the boom in India’s healthcare sector, fueled by government support, a stark reality remains – health insurance coverage is woefully inadequate. Only 37% of Indians have this crucial safety net, leaving a staggering 400 million vulnerable to financial burdens in the face of medical emergencies.

While both public and private healthcare systems exist, limitations in public funding push many towards private insurers, with Maharashtra, Tamil Nadu, and Karnataka leading the way in premium collection. This highlights the urgent need to bridge the gap between rising healthcare costs and accessibility, ensuring more Indians have the peace of mind and financial protection that comes with health insurance.

There are some financial aspects to consider. Government spending on healthcare is gradually increasing but still lags behind developed nations. Out-of-pocket payments have declined yet remain significant at 48% of total healthcare spending. While employer-sponsored health insurance is growing, concerns exist about rising costs.

Why Better Coverage is Needed:

India faces a growing burden of lifestyle diseases like non-communicable diseases including cancer. Additionally, medical advancements and technology drive up treatment costs, making insurance crucial. The NITI Aayog report of 2021 suggests existing schemes can only cover 95 crore individuals, highlighting the need for expansion.

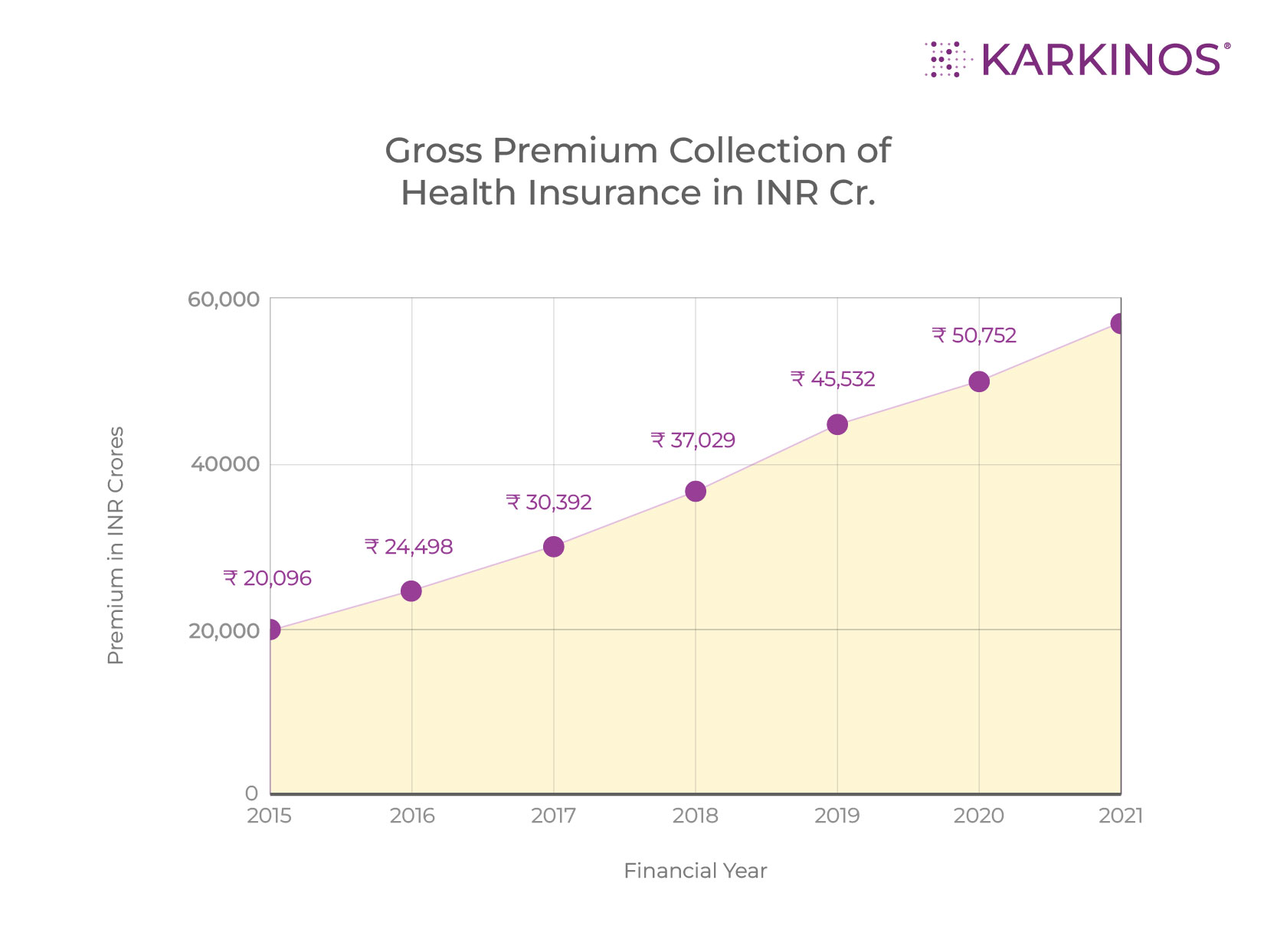

The COVID-19 pandemic served as a stark reminder of life’s uncertainties, triggering a 40% surge in health insurance premiums in 2020. This unprecedented rise reflects a heightened awareness of the critical role health insurance plays in safeguarding both health and finances during unforeseen times. However, the sobering reality is that low penetration rates leave many Indians dangerously exposed to financial burdens during medical emergencies. With rising healthcare costs and the growing prevalence of lifestyle diseases, adequate health insurance coverage is no longer just desirable, it’s essential (Maheshwari, 2023).

Impact and Role of Karkinos Healthcare

Standard health insurance plans in the country offer basic coverage but may fall short for cancer’s complex and expensive treatments. Karkinos Healthcare uses innovative and proactive approaches to address this.

The Company offers specialised Cancer Suraksha Plans specifically designed to cover cancer-related treatments, medications, and procedures. It also offers plans that advocate for early detection of cancer, thereby reducing the cost of these treatments. These plans, when included in health insurance covers, offer comprehensive coverage for treatment, and post-treatment care. This caters to reducing the complexity and cost of cancer treatment by bringing all fragments of cancer care into one ecosystem.

By utilizing data analytics and machine learning, Karkinos Healthcare assesses the risk of cancer for individuals based on factors like family history, lifestyle, and genetic predispositions. This allows them to offer personalised insurance plans with appropriate coverage levels tailored to the individual’s profile.

Karkinos Healthcare assists through its network of Karemitras who coordinate with the patient and the doctors throughout the treatment journey. With their network of hospitals, time spent travelling to larger apex centres is reduced and the need for frequent in-person visits also comes down, saving time and money.

The early detection cancer scheme promotes a healthy lifestyle for people, helping people break the stigma around cancer and be more proactive at an earlier stage in their lives. This not only reduces financial burden but emotional stress on the patient and their family members.

Through these measures, Karkinos Healthcare is helping to bridge this gap in the health insurance market by partnering with insurance service providers who offer comprehensive coverage for cancer patients through their entire journey of cancer care.

Disclaimer: Karkinos Healthcare is not a legalised insurance company. The company partners with a network of reputable insurance providers who can offer you a selection of insurance plans that may meet your specific needs.

Sri Sathya Sai Institute of Higher Learning.

Sri Sathya Sai Institute of Higher Learning.